Table of Contents

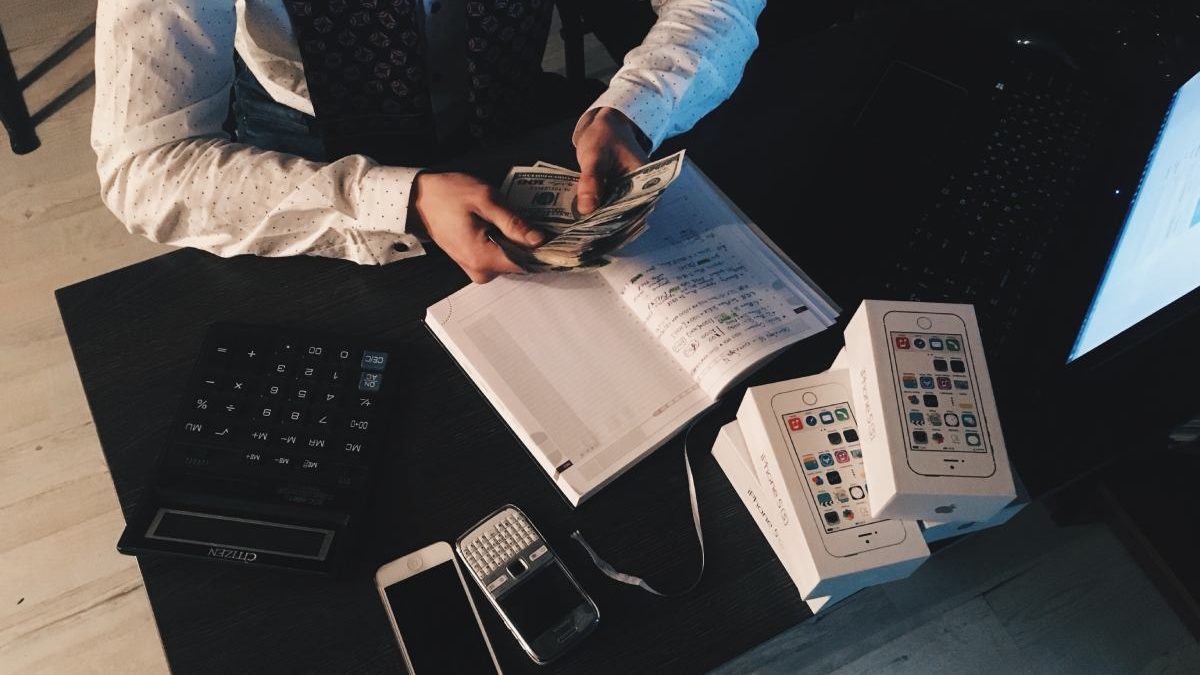

Cash Register (Cash Entry)

Cash Entry in companies is an essential component of recording financial transactions. The cash journal is one of the documents the company can provide in the event of an audit. It is also an important position for strategic decision-making.

Management of Cash Entry for Counter Sales

At a point of sale, the cash record is the first terminal on which the various operations record. Opening the cash register, closing the cash register, cashing, and giving change is part of the daily life of salespeople. You have to be able to take care of the customer’s means of payment, as well as commercial gestures such as discounts. A powerful cash entry software also allows invoicing

Each of these operations is then transcribes into the accounting books.

Accounting for Cash Transactions

Accounting entries relating to the cash register relate to specific accounts, depending on the mode of payment and whether it is a collection or a disbursement.

The recordings always make in chronological order, without erasures or blanks. This level of requirement naturally leads to the use of dematerialized accounting tools. When there is cash payment, the cash journal update in detail for all sales over €75, including tax per transaction. When the sums are less critical, it is allowed to carry out the transcription at the end of the day.

According to the standards of accounting entries defined by the general chart of accounts, the cash account is 53.

It is debited with each cash payment transaction and then credited:

- 70 “Sales of products, services, goods” (excl. VAT),

- 44571 “VAT collected.”

For cash and credit card payments, the accounts must credit:

- 5112 “Checks to cash,”

- 5115 “Bank cards to be cashed.”

Accounting for payments must be meticulous for editing the cash journal. When the day is not closed, we will talk about cash X. This allows for a temporary state. For the final closing, the software issues a cash Z. It is called Ticket Z, which summarizes the whole day.

Business Management: Monitoring Cash Transactions

It is common for a business to account for all means of payment in the cash register (cash, check, credit card, etc.) to monitor its activity over different periods. Careful monitoring of the cash balance is essential for the company’s management and income evolution. These analyzes make it possible to determine the commercial strategy, for example, by analyzing seasonality phenomena.

The cash balance is still in debt. In accounting, all cash transactions transcribe into the cash register. Sales enable cash inflows, while purchases and bank deposits create cash outflows. When the balance is in credit, there have been more money outflows than inflows.

A company’s revenue increases its turnover. However, the cash balance does not correspond to the turnover! Indeed, this last indicator represents only the money inflows.

Decentralization of Cash Entry

Cash register software solutions allow it to decentralize data for better use. Indeed, the connection with the accounting software facilitates the registration of supporting documents and the entry of accounting entries.

The cash diary summarizes the financial movements. In all cases, for counter sales, the cash register tape and the cash register (digital or handwritten document) list: a description of the deal, date, price, and VAT.

As part of the fight against VAT scams, since January 1, 2018, all cash register software must be secure and certified compliant.